Oversubscription for the Second Phase of Bond Listing Reflects Investors’ Confidence in PPCBank’s Performance and Stability

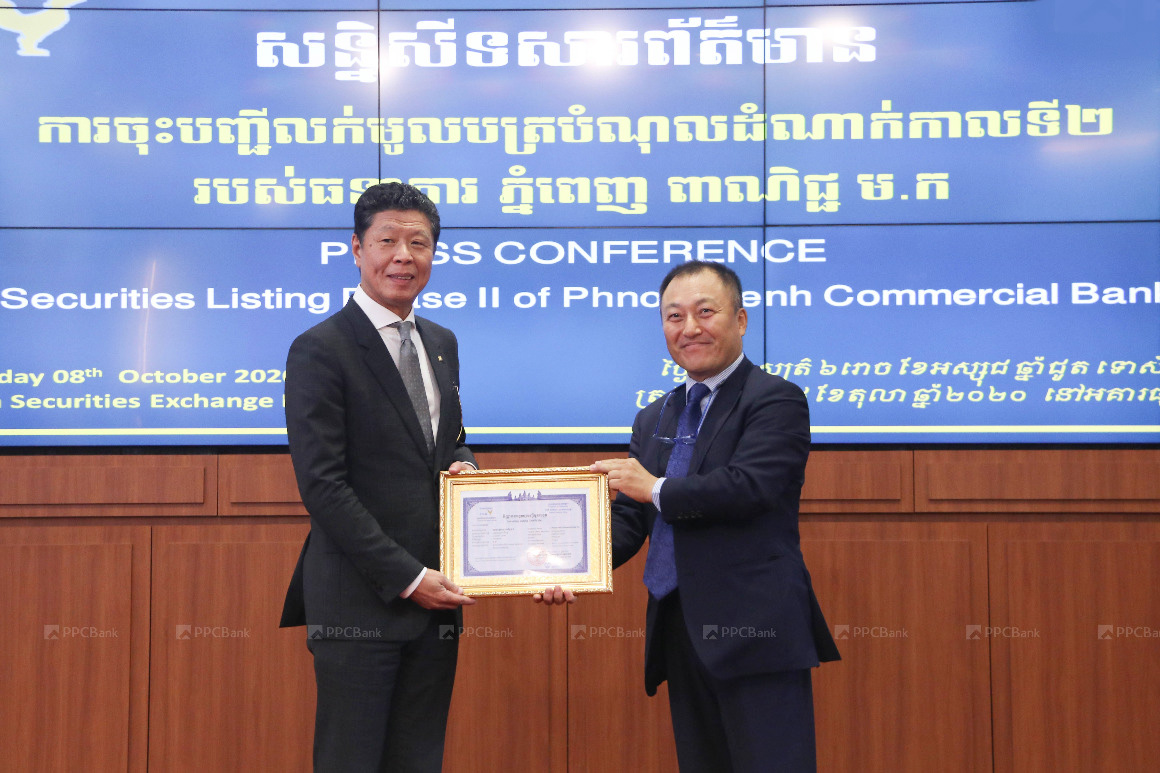

Phnom Penh (October 8, 2020) Today at the press conference of PPCBank’s Bond Listing, Phase II, held at Cambodian Securities Exchange (CSX), it was announced that PPCBank had successfully issued Phase 2 of its corporate bonds.

As one of the leading commercial banks in Cambodia, PPCBank successfully raised KHR 40 billion by issuing Phase 2 of its corporate bonds on September 22, 2020.

Despite the Covid-19 pandemic, the second phase of PPCBank’s bond listing was highly oversubscribed, attracting the interest of institutional investors from various industries. The Phase 2 bonds will be listed on the Cambodian Securities Exchange on October 9, 2020.

Mr. Shin Chang Moo, President of PPCBank, said, “We are delighted to have issued both phase 1 and 2 of our public bonds within this year despite the outbreak of the Covid-19 pandemic. The oversubscription of our bonds reflects investors’ confidence in our strong business performance and stability. We would like to thank each investor that spent their valuable time and money to invest in our corporate bonds during this unprecedented time.”

Mr. Han Kyung Tae, Managing Director of Yuanta Securities, said, “Due to the Covid-19 pandemic, we advised PPCBank to issue the bonds in two phases. This was a new approach that has not been done before in Cambodia. We were able to complete this project successfully thanks to the commitment from PPCBank, full support from the regulators, and participation from reputable local insurers and commercial banks.”

PPCBank listed Phase 1 of their corporate bonds and had a listing ceremony on April 21, 2020, during the uncertain times when Covid-19 was on the rise. The ceremony was held with a limited number of participants, strictly following government orders on social distancing and hygiene regulations.

PPCBank issued a total of KHR 80 billion worth of bonds in two phases. The bonds have a tenor of 3 years, and the final coupon rate of the bond is 6.5% per annum.