PPCBank’s Mobile Banking 2.5 enables customers to open new bank accounts online (e-KYC) and enjoy the latest digital payment (KHQR)

Phnom Penh, 11 April 2022 – PPCBank has introduced a major upgrade to its digital banking services as it works to make banking ever easier and assist the National Bank of Cambodia to improve levels of financial inclusion by bringing the unbanked into the Kingdom’s banking system.

Cornerstones of Version 2.5 include: a new function that allows customers to onboard and opens an account without needing to visit a branch (e-KYC); improved merchant payment accessibility through the new KHQR code; improved online payment capabilities for online merchants also using KHQR framework; improved Push Notifications, as well as increased speed, Face ID and a whole new interface.

e-KYC

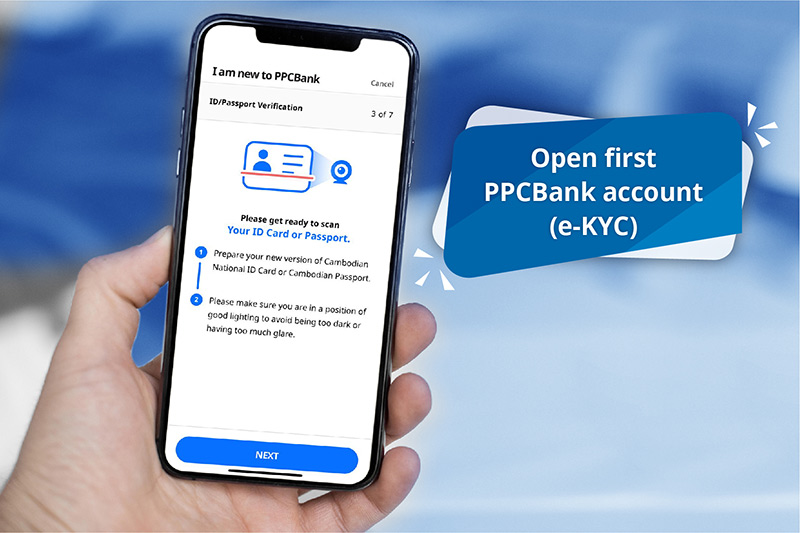

What PPCBank’s Version 2.5 does is bring ‘KYC’ into the digital banking age, allowing new customers to onboard and open accounts instantly through PPCBank Mobile App. This paperless process not only saves time but also minimizes the cost and necessary red tape associated with the more traditional ‘KYC’ process. All customers had to do is scanning original Cambodian ID or passport then live face; and PPCBank smart verification system will make sure that genuine customer is onboarding. The only time an e-KYC customer would need to visit a PPCBank branch in person, would be if they opted to upgrade their account. Once account is upgraded, customers can enjoy many more services available in stores designed to fulfill all their banking needs such as opening a monthly installment, term deposit account or even getting an instant loan using deposit account as collateral.

While the introduction of e-KYC will be good news for those with multiple bank accounts, it will be of particular benefit to Cambodia’s unbanked, who have never opened a traditional bank account before. First account with PPCBank can now be opened anywhere and at any time, in less than five minutes. PPCBank hopes this streamlined and digitally enhanced onboarding process will encourage more Cambodians to seek the security and convenience of a formal bank account for the very first time.

KHQR

PPCBank is cooperating closely with the National Bank of Cambodia as it works tirelessly to modernize the Kingdom’s banking system and enhance levels of inter-bank digital connectivity. As an extension of its Bakong Payment Platform, which enables fund transfers to be made instantly between member banks, the NBC has also now introduced a national QR code for banks and their merchants, called KHQR. This is now also featured on the PPCBank Mobile App as part of Version 2.5.

KHQR enables QR code payments to be made through the PPCBank Mobile App even at another bank’s merchants. All customers need to do is scan the merchant’s QR code, even if that merchant uses a different bank. Payments are made instantly. This upgrade also means that PPCBank merchants can receive instant QR code payments from another bank’s mobile users.

Improved User Experience

Version 2.5 of PPCBank’s mobile services focuses on enhanced functionality and convenience for customers and merchants alike. It also has a new look and feel with a redesigned interface. This upgrade gives the important features of comparing all transfer channels to find the fastest and cheapest channel, known as “Intelligent Fund Transfer”.

PPCBank Mobile App 2.5 is quite literally 2.5-times faster than Version 2.0, with key functions and processes taking a matter of seconds. Together with smartBiz, it also features Face ID for iOS smartphones. Push notifications have also been improved across both the PPCBank Mobile App and smartBiz. In the PPCBank Mobile App, push notifications and in-app messages can be set to any one of no fewer than five languages (Khmer, English, Korean, Mandarin, and Japanese).

PPCBank is excited to launch Version 2.5 of its digital banking services. The uptake of its mobile banking apps, smartBiz and the PPCBank Mobile App has seen tremendous growth over the past three years as it aims to making banking even easier. The silver lining in the cloud that was the pandemic has been the huge switch to cashless transactions and PPCBank has been proud to play its part in ensuring that Cambodians stay safe and bank with confidence. Digitalization will remain at the forefront of the bank’s continued growth and development.

Download our Mobile Banking App now and experience opening an account to enjoy a world of benefits from PPCBank. You can download the app from App Store or Google Play.

Click this link to download your Mobile Banking App: https://ppcbank.com.kh/app/